Simple ira withdrawal calculator

Find a Dedicated Financial Advisor Now. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Student Loan Calculator Bankrate Com Savings Calculator Miles Credit Card Credit Cards Debt

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

. You are retired and your 70th birthday was July 1 2019. For 2022 annual employee salary reduction contributions elective deferrals Limited to 14000. While banks typically offer a lower return on savings.

And from then on. Colorful interactive simply The Best Financial Calculators. SIMPLE IRA Business 401k.

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. For employees age 50 or over a 3000 catch-up contributions. Unfortunately there are limits to how much you can save in an IRA.

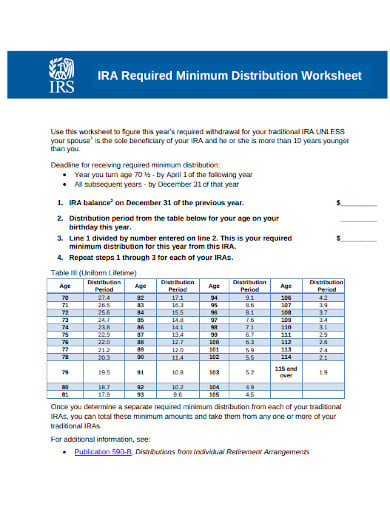

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Required Minimum Distribution Calculator.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. A savings account is a bank account where you can keep your money securely and earn some interest in the meantime. Use our IRA calculators to get the IRA numbers you need.

Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. Money deposited in a traditional IRA is treated differently from money in a Roth. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Currently you can save 6000 a yearor 7000 if youre 50 or older. Unless you qualify for an exception youll have to pay an additional 10 tax on the amount you withdraw from your SIMPLE IRA. Individuals will have to pay income.

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe. The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

Do Your Investments Align with Your Goals. You generally have to start taking withdrawals from your IRA SEP IRA SIMPLE IRA or retirement plan account when you reach age 72 70 ½ if you reach 70 ½ before January 1 2020. If its not you will.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Do Your Investments Align with Your Goals. This additional tax increases to 25 if you make the.

Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Use This Calculator to Determine Your Required Minimum Distribution. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Since you took the withdrawal before you reached age 59 12 unless you met one. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Find a Dedicated Financial Advisor Now.

A SIMPLE IRA is funded by. Calculate your earnings and more. Please visit our 401K Calculator for more information about.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal.

Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs.

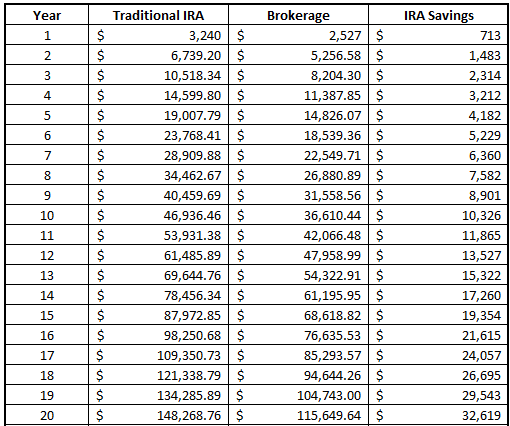

Retirement Withdrawal Calculator For Excel

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

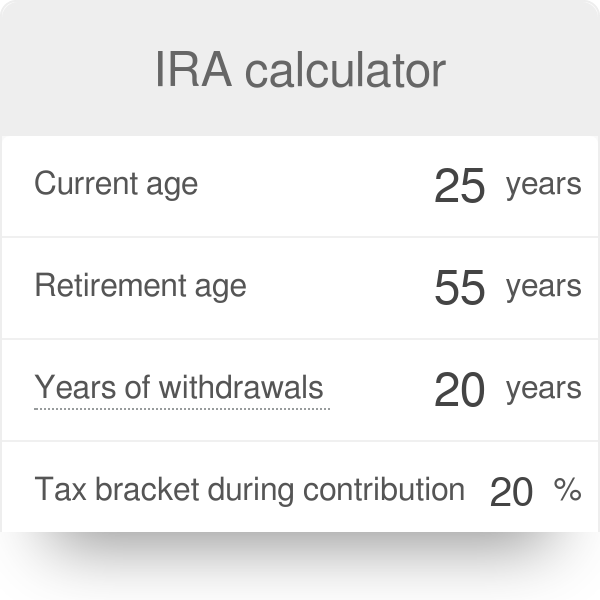

Ira Calculator

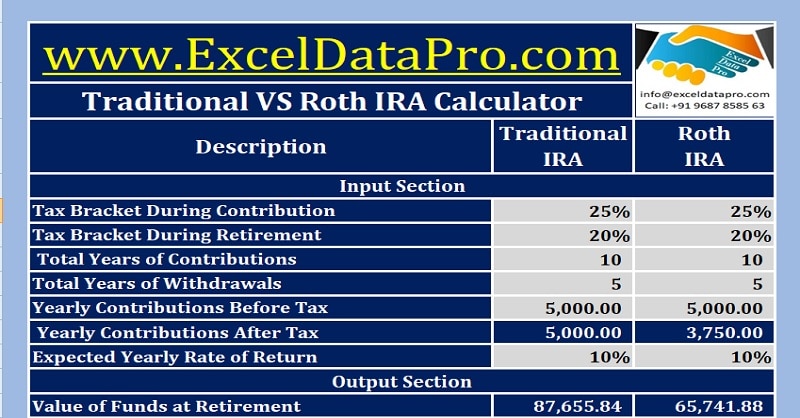

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Traditional Vs Roth Ira Calculator

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Calculate Your Net Worth The Only Financial Number That Matters Net Worth Budgeting How To Plan

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Canada Rates Interest Retirement Fund Early Retirement Health Savings Account

Download Free Traditional Ira Calculator In Excel